MYGA Rates

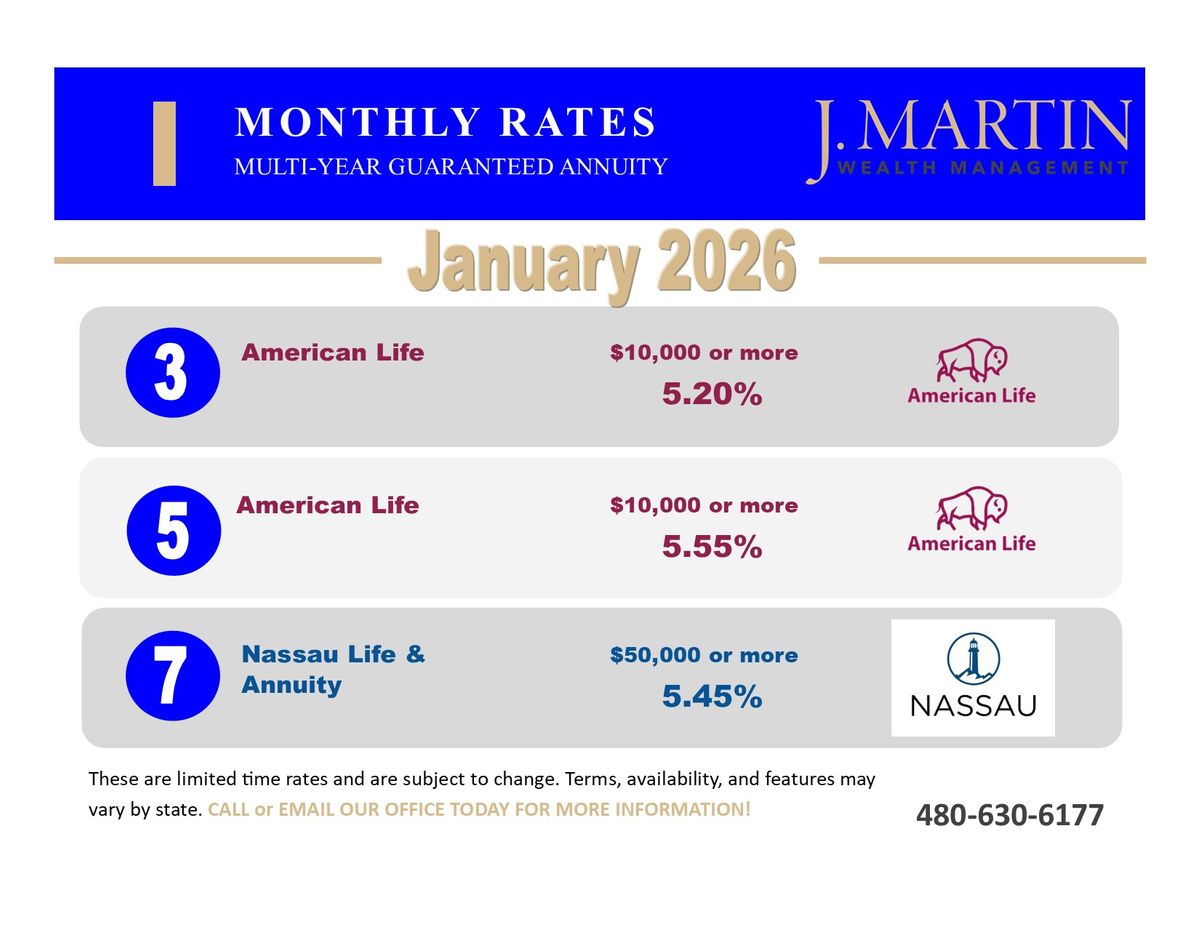

Arizona Multi-Year Guaranteed Annuity (MYGA) Rates – January 2026

Multi-Year Guaranteed Annuity (MYGA) Rates – January 2026

Looking for fixed-rate growth with principal protection? MYGAs offer a predictable interest rate over a set term. Below are current rates from two well-rated insurance carriers, based on premium amounts and duration.

Arizona January 2026 Rates

What does a MYGA offer?

Are you concerned about the uncertainty of fluctuating interest rates? Protect your hard-earned savings with a Multi-Year Guarantee Annuity (MYGA). MYGAs offer:

• Peace of Mind: Lock in a guaranteed interest rate for your chosen term, shielding your money from potential market declines.

• Predictable Growth: Enjoy the certainty of knowing exactly how your investment will grow.

• Tax Deferral: Earnings generally accumulate tax-deferred until withdrawal.

• Flexible Options: Choose terms from 2 to 7 years or more to suit your needs.

Important Considerations about Annuities:

MYGAs are insurance products with features that may differ from bank-issued CDs.

• Early withdrawals may incur surrender charges.

• It's essential to fully understand the terms and conditions of a MYGA before investing.

Don't let market uncertainty erode your savings. Contact us today to explore how a MYGA could offer security and growth potential for your financial future.

To better understand how these products fit into retirement income planning, it can be helpful to learn how annuities work.

Why Consider a MYGA?

Fixed interest rate for a specific period

-

Tax-deferred growth potential

-

Principal protection (subject to carrier’s claims-paying ability)

-

Simple structure with no market risk

Serving Arizona

We work with individuals and families throughout Gilbert, Chandler, Maricopa, and the surrounding areas. Whether you're approaching retirement or looking to protect savings from market volatility, MYGAs may be an option to explore.

Talk with a Financial Advisor

At J. Martin Wealth, we’ll help you understand how annuities might fit within your overall financial plan. Contact us today to learn more about current options and how to evaluate suitability.

Call 480-630-6177

Multi-Year Guaranteed Annuity Disclosure:

Fixed Annuities are long-term insurance contacts and there is a surrender charge imposed generally during the first 5 to 7 years that you own the annuity contract. Withdrawals prior to age 59-1/2 may result in a 10% IRS tax penalty, in addition to any ordinary income tax. Any guarantees of the annuity are backed by the financial strength of the underlying insurance company.

A MYGA is an annuity product issued by an insurance company, as opposed to a bank-issued CD. As with any financial product, it is critical to have a solid understanding of the provisions and features of a MYGA before making an investment decision. Our team is dedicated to providing guidance to assist you in determining how a MYGA may fit into your financial planning strategy.

Guarantees are backed by the claims-paying ability of the issuing insurer.