First Trust Monday Morning Outlook

Weekly Market Update from First Trust

First Trust Economic Outlook: Key Insights to Guide Informed Financial Decisions

The First Trust Monday Morning Outlook provides investors with timely insights on the latest market trends and economic updates.

Brian Wesbury, Chief Economist at First Trust Advisors, provides a weekly economic outlook through "First Trust Monday Morning Outlook." He analyzes current economic data and trends to offer insights and predictions about the financial markets. Wesbury's commentary often covers topics such as inflation, interest rates, government policies, and global events. He is known for his optimistic views on the long-term prospects of the US economy.

Scroll down to listen to the latest podcast episode.

Want to know more about First Trust Advisors?

Discover insights from Brian Wesbury and First Trust Advisors. Explore our investment solutions and learn how economic trends may influence your retirement strategy. Schedule a complimentary consultation today for guidance on aligning your financial goals with current market conditions.

Ep 61 | Bob Stein | What Surprises Are Ahead for the US Economy in 2026? | ROI Podcast January 5 2026

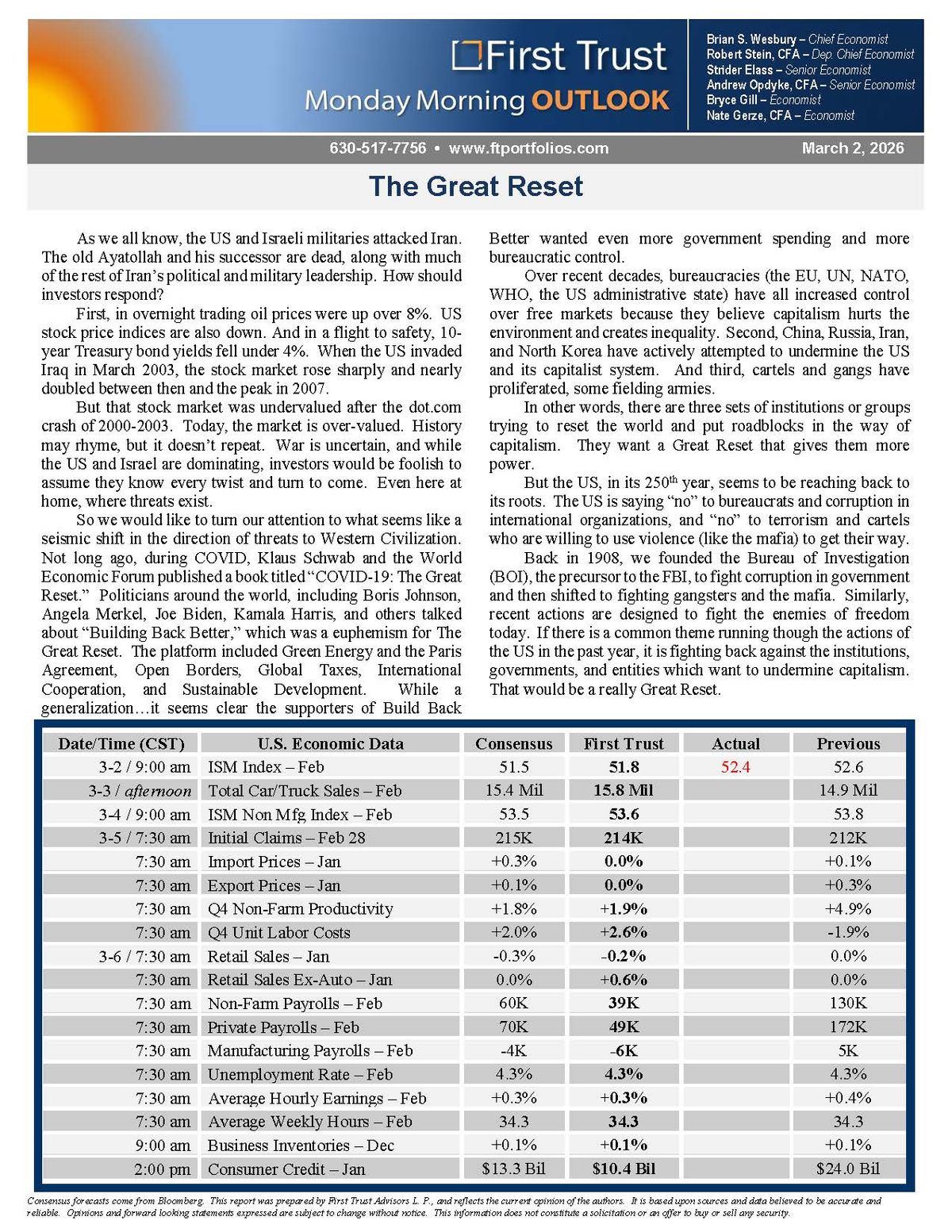

In this week’s First Trust Monday Morning Outlook video commentary, the First Trust economics team reviews the economic backdrop as the U.S. moves into 2026. They reflect on 2025 data showing resilient GDP growth and strong stock market gains, even as inflation cooled and labor markets remained steady. The video explains that while economists expected slower growth, real-world results surprised to the upside. It discusses ongoing risks — including high valuations in equities, inflation dynamics, and geopolitical uncertainties — and emphasizes the importance of focusing on data rather than headlines when interpreting economic signals. The team also highlights key data points for the coming week, such as employment figures, manufacturing indexes, and consumer credit trends, to inform market expectations and macro outlooks for the year ahead.

Watch the First Trust Monday Morning Outlook for January 5, 2026, with economist commentary on economic growth, market performance, inflation trends, and key data to watch this week.

Who is Brian Wesbury?

Brian Wesbury serves as the Chief Economist at First Trust Advisors, L.P., a financial services company headquartered in Wheaton, Illinois. Additionally, Wesbury holds the position of a senior fellow at The Heartland Institute and is an active member of the Board of Advisors for First Trust Capital Partners, an affiliated private-equity firm. He has received recognition as the leading U.S. Economic Forecaster by the Wall Street Journal.

Brian Wesbury initiated his professional journey in 1982 with the Harris Bank in Chicago. His earlier roles encompassed the position of Vice President and Economist at the Chicago Corporation, as well as Senior Vice President and Chief Economist at Griffin, Kubik, Stephens, & Thompson. From 1995 to 1996, he assumed the role of Chief Economist for the Joint Economic Committee of the U.S. Congress. Mr. Wesbury holds an M.B.A. from Northwestern University's Kellogg Graduate School of Management and a B.A. in Economics from the University of Montana.

“When freedom prevails, the ingenuity and inventiveness of people creates incredible wealth. This is the source of the natural improvement of the human condition.”

― Brian S. Wesbury

Disclosure:

*The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code, or any other regulatory framework. Source:https://www.ftportfolios.com/retail/aboutus/aboutus.aspx

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from thirdparty sources is believed to be reliable though its accuracy is not guaranteed, and J. Martin Wealth Management makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that J. Martin Wealth Management may link to are not reviewed in their entirety for accuracy and J. Martin Wealth Management assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from J. Martin Wealth Management. For more information about J. Martin Wealth Management, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at 480-630-6177